When exploring loan apps or specifically need best loan app in Nigeria, it’s important to know the regulatory landscape. The Federal Competition and Consumer Protection Commission (FCCPC) looks out for consumer interests, while the Central Bank of Nigeria (CBN) oversees the financial sector. But here’s the thing: not all digital lenders are licensed by the CBN. Some are operating as finance companies (FCs), while others are Microfinance Banks (MfBs).

According to the CBN, there are over 100 licensed FCs and more than 600 licensed MfBs. Nevertheless, only a few of these licensed institutions are actively engaged in digital lending, focusing on personal loans. So, it’s crucial to do your research and verify a lender’s credentials before signing up. To avoid predatory lending practices, be sure your desire loan app is licensed by the CBN to ensure your protection than potential risks.

Some licensed loan apps stand out from the rest, offering flexible repayment plans, low interest rates, and high loan amounts. This are popular choices, with user-friendly interfaces and quick loan disbursal.

| N/S | Best loan apps in Nigeria | Amount | Monthly rate |

| 1. | Branch International Financial Services | ₦2,000 to ₦1,000,000. | 15% -34% |

| 2. | Renmoney Microfinance Bank | ₦7,500 to ₦ 6,000,000 | 2.5%-7.5% |

| 3. | Baines Credit Microfinance Bank Limited | ₦100,000 to ₦1,800,000 | 4.5% |

| 4. | Ekondo Microfinance Bank | ₦50,000 to ₦500,000 | 1-3 Months 20% |

| 5. | Newedge Finance Limited | ₦2,500 to ₦300,000 | 5%-8% |

| 6. | Firmus Microfinance Bank | ₦500,000 to ₦2,000,000 | 5% |

| 7. | EaseMoni Microfinance Bank | ₦3,000 to ₦1,000,000 | 10% |

| 8. | Carbon Finance and Investment Limited | ₦2,500 to ₦500,000 | 4-30% |

| 9. | FairMoney | ₦1,500 to ₦500,000 | 2.5-30% |

Best Loan App evaluation

- Branch International Financial Services:

Branch International Financial Services, also known as Branch, has been operating in Nigeria since 2017, providing mobile loans and financial services. Branch, was given license by the Central Bank of Nigeria (CBN) in March 2015. Its processing loan within 24 hours to customers when they their application.

2. Renmoney Microfinance Bank:

Renmoney Finance Company Limited is a licensed finance company in Nigeria. It was incorporated on August 16, 2012, and received its operating license from the Central Bank of Nigeria (CBN) on October 25, 2012.

3. Baines Credit:

Baines Credit started operations in 2011 and received its microfinance bank license from the CBN in 2012. They focus on providing loans and financial assistance to individuals and small businesses mostly to salary earners.

4. Ekondo Microfinance Bank:

Ekondo Microfinance Bank is a licensed microfinance bank in Nigeria. It was incorporated on June 20, 2007, and received its operating license from the CBN on December 18, 2007. Ekondo, is offering features of financial facilities mostly to civil workers.

5. Newedge Finance Limited:

Newedge Finance Limited is a licensed finance company in Nigeria. It was incorporated on October 25, 2013, and received its operating license from the CBN on February 25, 2015. Newedge do offer loan through various channel like Palm credit, Xcash among others.

6. Firmus Microfinance Bank:

Firmus Microfinance Bank is a licensed microfinance bank in Nigeria. It was incorporated on October 14, 2008, and received its operating license from the CBN on May 14, 2009. Firmus Microfinance is offering personal loan, house loan, and car loan.

7. EaseMoni Microfinance Bank:

Easemmoni is a licensed microfinance bank in Nigeria. It was incorporated on November 28, 2007, and received its operating license from the CBN on June 25, 2008. It is specializing on school fee loan among others like house loan and maintenance.

8. Carbon Finance and Investments Limited:

Carbon Finance and Investments Limited is a licensed finance company in Nigeria. It was incorporated on August 14, 2013, and received its operating license from the CBN on March 11, 2015. It offers huh amount of loan to users for investments, at times do take longer time than necessary.

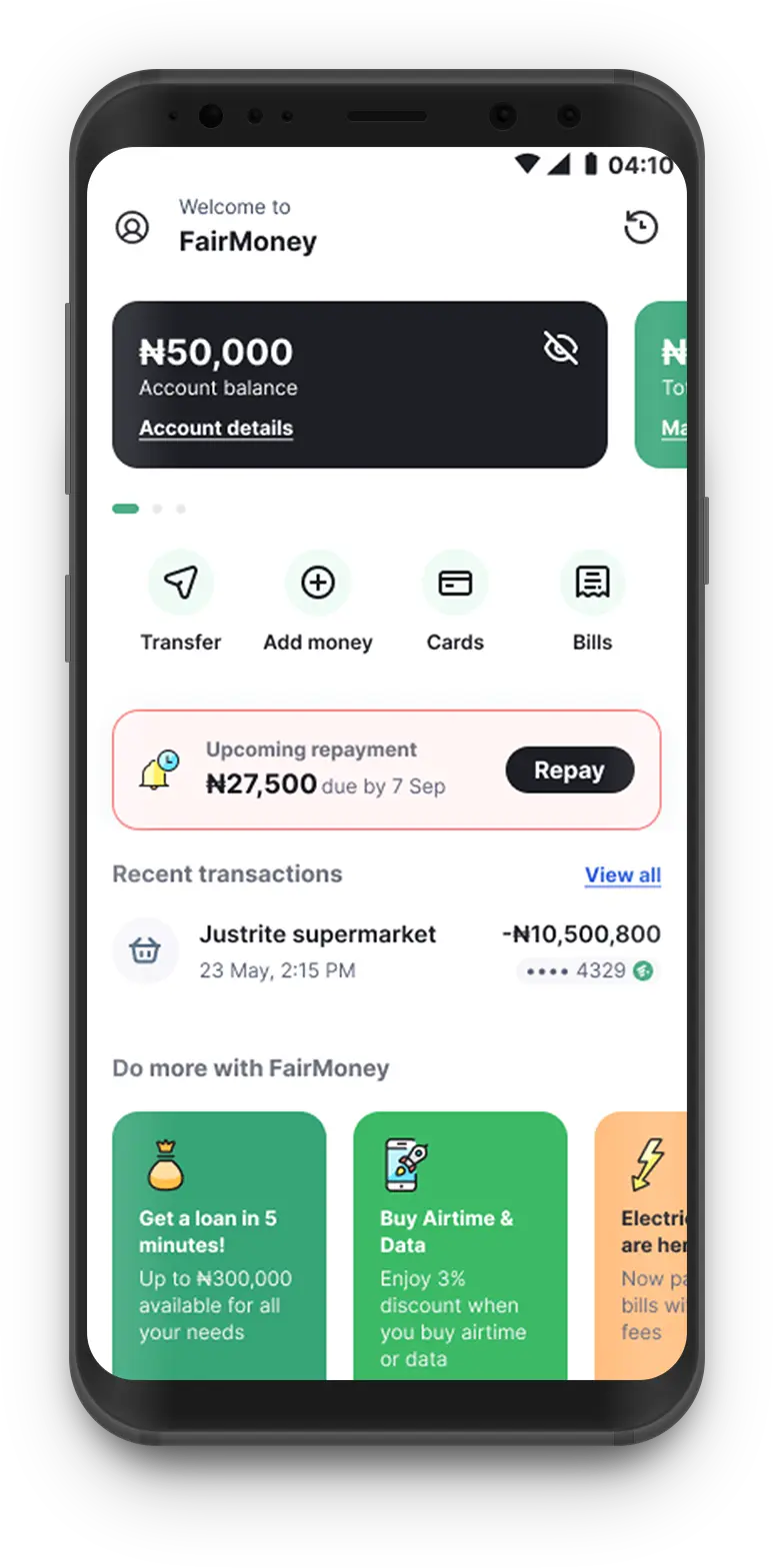

9. FairMoney:

FairMoney is a licensed microfinance bank in Nigeria. It was incorporated on December 11, 2015, and received its operating license from the CBN on June 27, 2016. Fairmoney app, is trending with features of offering debit cards and account number to its customers.

What to know

When picking a loan app, there are a few things to keep in mind. First, look for one loan platform with a low interest rate you will not owe much in the long run. Some apps charge way are more interest than others, so it’s important to compare rates before give a try.

Next, make sure the app can lend you the amount you need. Some apps have pretty low limits, while others can lend more. And think about the repayment plan – do you want to pay back a little at a time, or all at once? Choose an app that fits your financial style.

Finally, check out what other users have to say about the app. Read reviews and ratings to get a sense of whether it’s trustworthy and reliable. By considering all these factors, you can find a loan app that works for you.

Conclusion

Make research to compare loan apps carefully, considering interest rates, loan amounts, repayment plans, and user reviews, to make informed borrowing decisions and maintain a healthy financial future.